Opportunity

Opportunity

With the R&D Tax Credit now being permanent, the timing has never been better for the Architecture Industry to take advantage of these often-substantial credits:

-

- The R&D Tax Credit provides a dollar for dollar reduction in a company’s tax liability;

- In addition to current year tax savings, the credit can generate a refund of taxes previously paid for open tax years (generally the prior three years); and

- The credit can be used as a carry-back for one year and a carry-forward for 20 years if your company does not have immediate utilization for these credits.

Furthermore, the rules for calculating and claiming the R&D Tax Credit has recently become more taxpayer-friendly. Meaning, if your architecture firm has looked into R&D Tax Credits in the past but were worried about stringent qualification standards or the difficulty of the calculation itself, these recent changes should make you take another look:

-

- The Alternative Simplified Credit (ASC) method can now be elected on amended returns instead of only on original-filed returns. Introduced in 2006, the ASC is equal to 14% of total qualified research expenses that exceed 50% of the average qualified research expenses for the three preceding taxable years. This method is less complicated than the “regular credit” calculation created in 1981 and does not rely on antiquated data.

- The definition of prototypes has been more clearly defined and made easier to qualify. This is often where you will find opportunities for a large portion of qualified research expenses.

- There are new definitions to clarify the definition to Internal Use Software.

In addition to the federal R&D Tax Credit, over 35 states have an R&D incentive program. These state credits typically follow federal regulations but have different tax rates and utilization methods. As such, taxpayers can benefit from both federal and state R&D credits to minimize their tax liability and be paid to innovate while growing their local economy.

Qualifications

Qualifications

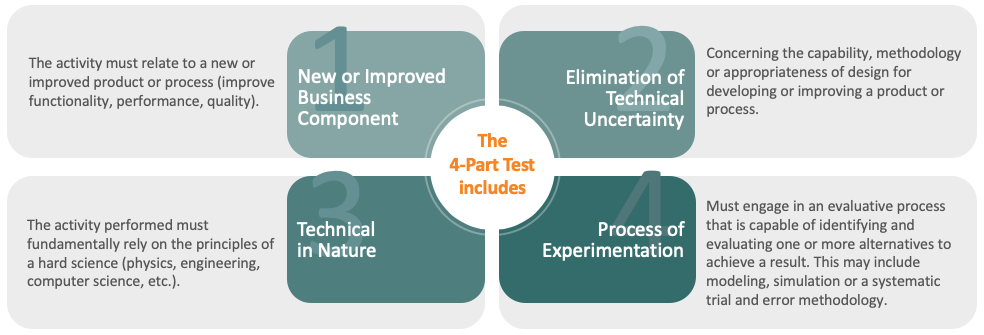

There is a common misconception that R&D only occurs in laboratories of high-tech research facilities, but the definition of R&D activity is quite broad and includes multiple industries and types of activities. The R&D tax credit utilizes a four-part test to determine what constitutes a qualified research activity (QRA):

THE FIRST PART OF THE TEST IS THAT THE ACTIVITY MUST RELATE TO A NEW OR IMPROVED PRODUCT OR PROCESS RELATING TO FUNCTION, PERFORMANCE, RELIABILITY, OR QUALITY.

Almost everything an architecture firm creates is customized and highly innovative. From designing single family homes to developing full-scale commercial buildings, architecture firms are constantly finding new ways to create unique and functional yet energy-efficient designs. Activities related to the design and development of new or improved designs are referred to as business components.

THE SECOND PART OF THE TEST REQUIRES THE ELIMINATION OF A TECHNICAL UNCERTAINTY

This means the activities must be intended to discover information to eliminate uncertainty concerning the capability, methodology, or appropriateness of design for developing or improving a product. Architecture firms are presented with many uncertainties throughout the entire design and development process. These uncertainties typically revolve around the final design or the ideal methodology of development. For example, almost every structure or space created requires a new design and must satisfy specific functionalities and capabilities. Even if you have an initial conceptual idea for the design, certain spatial constraints or design requirements may lead to design changes or improvements in the final product. Additionally, LEED and other environmental requirements are constantly evolving. This may lead to uncertainty regarding the capability and methodology of efficiently integrating energy efficient equipment and materials into the design while also satisfying customer requirements.

THE THIRD PART OF THE TEST REQUIRE A PROCESS OF EXPERIMENTATION

This means that the architecture firm must engage in a technical process that analyzes one or

more alternatives to achieve a result. Don’t let this test scare you off by envisioning lab coats and beakers! Although those types of activities certainly constitute a process of experimentation, this test includes anything from developing multiple design iterations to computer modeling and conducting simulations. The key here is the evaluation of alternatives:

![]() Did you analyze multiple designs?

Did you analyze multiple designs?

![]() Did you utilize computer simulations to determine weaknesses in a design and then improve upon that?

Did you utilize computer simulations to determine weaknesses in a design and then improve upon that?

![]() Did you evaluate different types of materials and/or equipment models in order to satisfy both environmental parameters and customer requirements?

Did you evaluate different types of materials and/or equipment models in order to satisfy both environmental parameters and customer requirements?

![]() Did unanticipated site changes or customer specifications require you to generate new conceptual or schematic designs?

Did unanticipated site changes or customer specifications require you to generate new conceptual or schematic designs?

Architecture firms typically have a defined and formal process of experimentation – including a conceptual or schematic design phase, a design development phase, and a construction document phase. During the early conceptual or schematic design phase, you may undertake an iterative design process in which you create and evaluate multiple design options in the form of sketches, drawings, and diagrams. During the design development phase, you may evaluate alternative drawings utilizing computer modeling or conduct testing to determine the optimal material to be used. During the construction documents phase, you may continue to evaluate and improve the drawings and designs based off the site’s unique requirements and features. All of these activities include a process of experimentation.

FINALLY, THE FOURTH PART OF THE TEST REQUIRES THAT THE ACTIVITY PERFORMED MUST BE TECHNOLOGICAL IN NATURE, FUNDAMENTALLY RELY ON PRINCIPLES OF CHEMISTRY, PHYSICAL OR BIOLOGICAL SCIENCE, ENGINEERING, ETC.

This is an easy one. Architecture firms are continuously utilizing the principles of hard sciences such as architectural engineering, structural and civil engineering, and materials sciences in order to design and develop new or improved structures. For example, did you evaluate multiple materials to determine which could satisfy functionality and performance requirements? Did you conduct seismic testing and modeling to ensure the building would be structurally sound given certain environmental conditions? Maybe you evaluated multiple designs to determine the optimal dimensions and measurements of each room given certain spatial constraints. The examples of qualified scientific principles for this fourth test are endless.

Credits

Credits

So now that we have identified your qualified research activities, how does that translate into tax credits? These activities generate qualified research expenditures (QREs) that fall into one of three buckets: wages, supply costs, and contractor costs.

WAGES – this consists of qualified wage expenses, identified through direct wages of technical employees or primary research personnel (along with support or supervisory personnel) who affect the research. For architecture firms, this can include architects, progect managers, drafters, and even interns assisting with design work.

SUPPLY COSTS – this consists of items used or consumed in the research and experimentation process. This can include materials utilized in the creation of a prototype component or costs associated with equipment that has been modified specifically for a new product or process. Due to the nature of their work, architecture firms do not typically have qualified supply costs.

CONTRACTOR COSTS – these are comprised of payments made to a third party to perform qualified research along with fees paid to consultants or outside testing firms. Examples for the architecture industry include any costs associated with utilizing third-party structural engineers.

ABGi USA

Business leaders choose ABGi as their tax incentive specialist because, for over 30 years, our expertise has allowed us to maximize their credits and deductions, decreasing tax liability the way the government intended. Our approach to work minimizes business disruption and produces high-quality, compliant work.