Current Congressional Bills

Info and Status

Below is the latest news and updates regarding the current legislation that has been introduced to reverse the TCJA implementation of Section 174 and restore the R&D Tax Credit to fully support innovation and economic development and provide a significant tax savings incentive for doing so.

Bookmark this page and check back often for updates, or subscribe to our latest news update email.

To receive email updates on the latest tax news, enter your email:

Latest News – October 8, 2025

The IRS Shutdown is Here — What It Means for Tax Incentives

The federal government shutdown is forcing the IRS to scale back operations, causing delays in credit processing, refunds, and correspondence. While tax laws remain unchanged, backlogs could slow R&D, 179D, and Cost Segregation claims. Businesses should continue filing electronically and stay connected for updates as ABGi monitors developments in real time.

Read Full Update →

September 5, 2025

IRS Issues New Guidance on R&D Expenditures – Short Windows to Act

The IRS released Revenue Procedure 2025-28 with new rules for handling R&D expenses under the OBBBA. The guidance is generally favorable, but the September 15 and October 15 deadlines create very narrow windows to act. Superseded returns and deemed elections may provide opportunities, but only if filings are made correctly and on time.

Read Full Update →

August 7, 2025

Act Now: Immediate R&D Expensing Restored; Retroactive Relief in Motion

With the One Big Beautiful Bill (H.R. 1) now law, immediate expensing of domestic R&D is permanently restored—opening meaningful tax-saving opportunities for businesses of all sizes.

- Section 174A: Immediate expensing begins for tax years starting in 2025; optional 10-year amortization or 60-month recovery available as applicable.

- Small Business Relief (<$31M avg. receipts): May amend 2022–2023 returns to fully expense R&D and make/update §280C elections; statutory amendment window runs through July 4, 2026 (earlier cutoffs may apply for certain late-election scenarios).

- Catch-Up for Larger Businesses: Prior amortized §174 expenses can be “turbo depreciated” in 2025 to align with immediate expensing; avenues also exist to amend for the credit and be made whole.

- Why Prepare Now: Early strategy and documentation (R&D studies, §280C analysis, cash-flow modeling) improve compliance, flexibility, and outcomes—especially for 2024 extended returns.

- Next Steps: Review 2022–2024 R&D, model amended vs. forward-looking positions, and align filing strategy with your CPA and ABGi.

Read Full Update →

July 9, 2025

Act Now: R&D Expensing Restored, Retroactive Relief Available for Small Businesses

With the One Big Beautiful Bill now law, businesses must act quickly to take advantage of full R&D expensing and other key provisions. While formal IRS guidance is pending, tax experts are urging immediate action—especially for small businesses seeking retroactive benefits.

- Section 174A: Full expensing permanently restored for tax years beginning January 1, 2025, with optional 10-year amortization or 60-month recovery.

- Retroactive Relief: Businesses under $31M in average gross receipts may amend 2022–2023 returns. Deadlines may range from 47 days to one year depending on prior filings.

- Section 179D: Phase-out begins for buildings starting construction after June 30, 2026.

- SALT Cap: Temporarily increased to $40,000 through 2030.

- Bonus Depreciation: 100% bonus depreciation extended through 2029 for qualified property.

Read Full Update →

July 3, 2025

Congress Passes the One Big Beautiful Bill

ABGi USA – Major Tax Reform Enacted

On July 4, the One Big Beautiful Bill was signed into law—restoring full R&D expensing, enabling retroactive relief for small businesses, and reshaping tax planning strategies across industries.

- Full R&D expensing restored (Section 174A)

- Retroactive relief for 2022–2023 returns

- Phase-out of Section 179D begins mid-2026

- SALT cap temporarily raised to $40,000

For a full breakdown of what’s in the bill and what comes next:

Read the full update →

July 2, 2025

Just in Time for the Fireworks: The One Big Beautiful Bill Heads to the President’s Desk

After a marathon House session and a dramatic tie-breaking vote in the Senate, the One Big Beautiful Bill has officially cleared Congress. The sweeping 940-page legislation is now en route to the President’s desk—just in time for Independence Day.

- R&D Expensing: 100% restoration with retroactive relief dating back to 2022 for small businesses.

- Amortization Options: Larger firms gain access to accelerated amortization schedules.

- Section 179D: Modified with phase-out beginning after June 30, 2026.

- SALT Cap: Adjustments made to increase flexibility for high-tax states.

Read Full Update →

June 30, 2025

Senate Advances “One Big Beautiful Bill” – Procedural Vote Signals Momentum for R&D Expensing Fix

On Saturday night, the Senate voted 51–49 to begin formal debate on the One Big Beautiful Bill. The 940-page draft includes full restoration of 100% R&D expensing and retroactive relief for small businesses dating back to 2022.

- Section 174: Immediate deductions restored; retroactive relief for small businesses with under $31M in average receipts.

- Next Steps: Senate debate and vote-a-rama begin this week; final vote expected by July 4.

- Section 179D: Proposed phase-out for energy-efficient building deductions starting after June 30, 2026.

Read Full Update →

June 18, 2025

Senate Unveils Latest Draft of “One Big Beautiful Bill” – Key Tax Provisions Sharpen into Focus

The Senate Finance Committee has released an amended version of the One Big Beautiful Bill Act, with updates that may dramatically impact R&D expensing, bonus depreciation, and nonprofit taxation.

- Section 174: Full suspension of R&D amortization, with retroactive application.

- Bonus Depreciation: 100% expensing restored through at least 2027.

- Section 163(j): Temporary return to EBITDA-based interest limits.

- Nonprofits: Expanded UBTI rules, excise tax changes, and return of fringe benefit taxation.

Read Full Update →

May 22, 2025

House Advances “One Big, Beautiful Bill Act” – Major Tax Provisions Clear Key Hurdle

This morning, the U.S. House of Representatives passed President Trump’s signature reconciliation package—the One Big, Beautiful Bill Act. While revisions are anticipated in the Senate, the vote represents a major milestone in advancing sweeping, pro-growth tax reforms.

What This Means for Business Leaders:

• Extension of 2017 tax cuts for individuals and corporations

• 100% R&D expensing (Section 174) from 2025–2029

• 100% bonus depreciation through 2029

• QBI (Section 199A) deduction raised from 20% to 23%

• SALT cap increased to $40K for households earning under $500K

• Federal tax elimination on tips, overtime, and auto loan interest

• Child Tax Credit increased to $2,500 through 2028

• Creation of new $1,000 “Trump Accounts” for children born 2024–2028

What’s Next:

• June: Senate takes up the bill with potential revisions

• July: Target date for final passage and signature

• R&D expensing likely to be a central point of Senate negotiation

Speaker Mike Johnson and House leadership successfully unified the GOP caucus—achieving a critical legislative win and accelerating momentum for business-friendly tax policy.

May 19, 2025

House Budget Committee Advances Tax Relief Bill with Major R&D and Small Business Provisions

On Sunday, May 18, 2025, the House Budget Committee narrowly approved a GOP-led reconciliation bill—advancing long-awaited tax relief measures for innovative and capital-intensive businesses.

The proposal includes key incentives:

• Full, immediate expensing for R&D costs (Section 174)

• Expanded 199A deductions for pass-throughs

• 100% bonus depreciation through 2029

• Increased Section 179 expensing limits for small businesses

With a full House vote expected before Memorial Day, negotiations are intensifying this week.

Read the full update and see what’s at stake.

April 30, 2025

R&D Expensing Remains in Play as House Eyes Memorial Day Vote

Momentum builds for tax reform as House Republicans push reconciliation package forward. Speaker Mike Johnson has confirmed that final committee work is underway, targeting a House floor vote the week before Memorial Day.

What This Means for Innovative Businesses:

• R&D expensing is still under active consideration

• Final committee markups begin the week of May 6

• Economic signals are fueling urgency for pro-growth tax policy

• July 4 remains the target for full passage of the package

Timeline to Watch:

• Week of May 6: Final House committee markups

• Week of May 13: Budget Committee assembles the full package

• Week of May 20: Tentative House vote on reconciliation

• June–July: Senate negotiations and final passage efforts

Treasury Secretary Scott Bessent indicated this week that the administration is aligned on the July 4 deadline — an ambitious but realistic goal as negotiations progress.

We’re continuing to monitor updates and will share more as the legislative picture becomes clearer. Stay tuned — and reach out if you’d like to explore how these changes could impact your business.

April 11, 2025

House Passes Budget That Paves Way for Permanent R&D Tax Relief

Narrow 216-214 House vote is a big win for American innovation.

The budget deal unlocks the path to permanently extend key provisions from the 2017 tax law — including long-awaited fixes to Section 174 and R&D expensing.

For startups and tech-driven businesses, this means:

• No more 5-year amortization hurdles

• A return to full, immediate expensing of R&D costs

• Greater certainty for long-term investment in U.S. innovation

This is a huge step and we’ll continue to update. Stay Tuned!

Read More

April 5, 2025

Senate Advances Budget Resolution: What It Means for Tax Policy

Over the weekend, the Senate passed a revised budget resolution in a narrow 51–48 vote, advancing President Trump’s domestic agenda—including tax cuts and spending priorities. The resolution now heads to the House, where internal divisions threaten to stall progress.

Key Developments to Watch:

- House vs. Senate Spending Cuts – Competing visions for fiscal restraint are causing friction among Republicans.

- Entitlement & Medicaid Reform Pushback – Concerns from moderates and budget hawks could delay consensus.

- Debt Limit and Reconciliation Strategy – Gaining access to reconciliation remains critical for enacting tax changes with a simple majority.

- Market Volatility – Uncertainty around tariffs is adding pressure to negotiations and public messaging.

The House Rules Committee will consider the resolution today, with a floor vote expected by midweek. Expect a wave of negotiations, lobbying, and political posturing in the days ahead as lawmakers race to pass the measure before the Easter-Passover recess.

Read More

March 14, 2025

Senate Passes Funding Bill: What’s Next for Tax Policy & R&D Expensing?

On March 14, 2025, the Senate passed a six-month funding bill in a 54-46 vote, narrowly avoiding a government shutdown. The bill, which now awaits President Trump’s signature, trims non-defense spending by $13 billion while increasing defense spending by $6 billion.

However, tax policy changes—such as restoring immediate R&D expensing under Section 174—were not included, meaning further legislative action is needed.

Momentum for R&D Expensing Reform:

- American Innovation and R&D Competitiveness Act of 2025 Introduced – On March 10, lawmakers introduced a bipartisan bill to restore full R&D expensing retroactive to 2022, reversing the amortization requirement from the 2017 Tax Cuts and Jobs Act.

- Budget Resolution Supports Tax Reforms – The House Budget Committee’s FY 2025 plan, passed in February, includes a $4.5 trillion tax-cut blueprint. A key component is the elimination of Section 174 amortization, allowing businesses to immediately deduct R&D expenses—a move aimed at strengthening U.S. innovation and competitiveness.

With the government funded for six more months, lawmakers now have an opportunity to prioritize tax policy. While bipartisan support for R&D expensing reform is growing, the timeline remains uncertain.

March 5, 2025

Trump Outlines Economic Plan: Key Tax Changes & Business Impacts

In his first major address since returning to office, President Trump proposed sweeping tax cuts, new tariffs, and incentives for U.S. businesses. Key proposals include permanent tax cuts, expanded expensing provisions, and a new auto loan interest deduction for U.S.-made vehicles. Additionally, reciprocal tariffs on imports are set to take effect April 2, 2025, potentially impacting global supply chains. As Congress begins reviewing these proposals, businesses should assess potential financial and tax implications. Read more.

February 26, 2025

Breaking News: House Passes Budget Resolution, Setting the Stage for Key Changes for Businesses

The House has passed a budget resolution, setting the stage for major tax changes impacting businesses. Expected provisions in the upcoming reconciliation bill include the restoration of immediate R&D expensing, the extension of 100% bonus depreciation, and business interest deduction relief. As the Senate reviews amendments, businesses should prepare for potential impacts. Read more.

February 14, 2025

IRS Updates Form 6765: New Documentation and Reporting Rules for R&D Tax Credit Claims

The IRS has finalized Form 6765 (Rev. December 2024) with major updates, increasing the detail required for research tax credit claims. Key changes include Sections E-G, which introduce new reporting on business components, officer wages, acquisitions, and detailed breakdowns of research costs. Section G, optional for 2024 but mandatory for larger companies in 2025, requires extensive documentation of research activities, reflecting recent tax court rulings emphasizing the need for precise record-keeping. Read More

January 13, 2025

Exciting News: Michigan Enacts a New R&D Tax Credit for 2025

Michigan has reintroduced an R&D tax credit for the first time since 2012, along with a $60 million Innovation Fund to boost innovation and economic growth. With refundable credits, special incentives for small businesses, and collaboration bonuses for partnering with Michigan universities, this program offers incredible opportunities for businesses of all sizes. Curious how your business can benefit? Read More

December 17, 2024

IRS Scrutiny in 2024: Preparation Tips for Businesses

The IRS is ramping up audits on programs like the Employee Retention Tax Credit (ERTC) and Section 174 claims, putting businesses under heightened scrutiny. While legislative changes, such as the potential repeal of Section 174, are anticipated, companies must adhere to current compliance requirements through 2024. Deadlines, including April 15, 2025, for amending payroll tax filings to claim the ERTC for 2021, remain critical. Proactive planning with tax consultants can help businesses safeguard incentives, strengthen documentation, and stay ahead of evolving tax laws. Read More.

November 14, 2024

Post-Election Analysis: What a GOP White House and Republican-Controlled Senate and House Mean for Key Tax Incentives

With President-elect Trump and a GOP-controlled Congress, significant tax policy shifts are on the horizon. Early action on Section 174 is expected, potentially reversing the five-year amortization of domestic R&D expenses. While green energy incentives like Sections 179D and 45L are available for 2024 filings, future changes may tighten wage and apprenticeship requirements. Cost segregation strategies remain stable, but enhanced IRS scrutiny on fraudulent Employee Retention Tax Credit (ERTC) claims could fund GOP tax priorities. Businesses should act now to maximize current tax benefits and prepare for legislative updates. Read More.

August 1, 2024

U.S. Senate Fails American Businesses

On August 1, 2024, the Senate failed to prioritize the financial challenges facing American businesses under the current Section 174 rules. Despite the overwhelming House approval of H.R. 7024 (The Tax Relief for American Families and Workers Act) six months ago, with a 357-70 vote, the Senate declined to move forward with a vote on the bill.

This inaction comes after 1,171 small businesses from across the U.S. signed a letter urging Senate leaders to address the negative impact of Section 174. Business owners described having to make drastic financial decisions, such as borrowing, incurring debt, and laying off staff, to pay their taxes. If the rules are not changed soon, many fear additional layoffs, closures, or bankruptcies.

H.R. 7024 would restore the previous, more business-friendly Section 174 rules, but the Senate’s inaction leaves many businesses in jeopardy. ABGI encourages all business owners affected by the current Section 174 regulations to contact their Senators and share the detrimental effects on their companies.

ABGi continues to support its clients with innovative strategies to navigate these challenges and remains at the forefront of advocating for reform that supports U.S. businesses and protects jobs. For more information and resources to contact your Senators, click here.

May 8, 2024

Sec. 174 Fix Looking to Find a Home in the FAA Bill

Senator Finance Chair Ron Wyden (D-OR) has recently stated that he is seeking to attach H.R. 7024, The Tax Relief for American Families and Works Act of 2024, as an amendment to the FAA reauthorization bill. H.R. 7024 overwhelmingly passed the House with a vote of 357-70 back on January 31st but opposition by some GOP members has stalled its progress in the Senate. H.R. 7024 includes restoration of immediate expensing of R&D related costs and removal of the amortization requirement that went into effect starting tax year 2022.

Sen. Wyden has been continuously attempting to forge a path that allows for H.R. 7024 to pass the Senate and head to the President’s desk for signature. The FAA needs to be reauthorized by May 10th but the Senate has already indicated the potential for a short-term extension of that May 10th deadline.

Senator Crapo (ID-R) has been the main opponent of H.R. 7024 and will very likely object to adding the tax bill to the FAA legislation. However, Sen. Crapo has been encountering some additional pressure from his fellow GOP members which may help provide an avenue for an agreement to be struck.

If you have any questions about how this update impacts your business, please contact us.

January 31, 2024

Section 174 Fix Passed by the House

H.R. 7024 (The Tax Relief for American Families and Workers Act of 2024), which includes the repeal of the current Sec. 174 rules, was passed by the House of Representatives by a vote of 357-70. This pivotal bill restores the ability of American businesses to fully deduct research and development expenses in the year they were incurred.

Notably, the bill is retroactive to tax year 2022, allowing American business owners who experienced a significant tax hike in 2022 due to the existing rules to benefit from additional tax savings.

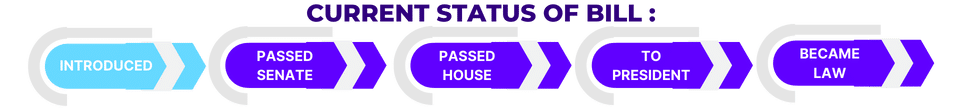

The bill now moves to the Senate for consideration and then to the President’s desk. We will be closely monitoring the situation and providing updates on new developments. For further details, access the news article here and reserve your spot for our upcoming webinar, where we’ll discuss the legislation’s implications.

January 19, 2024

House Reaches Deal on Sec. 174 Fix and Is Retroactive 2022

On Wednesday, January 16th, the House of Representatives announced a bipartisan agreement on a tax package known as the Tax Relief for American Families and Workers Act of 2024. The agreement includes the repeal of the current Sec. 174 rules and the restoration of immediate expensing for research and development expenses. Notably, the bill is retroactive to tax year 2022, allowing American business owners who experienced a significant tax hike in 2022 due to the existing rules to amend their 2022 tax returns. This presents an opportunity for them to potentially benefit from substantial tax savings.

We anticipate the bill to be submitted for consideration and a vote by the House by January 29th, after the drafting and markup process is complete. This is fantastic news for American businesses, and we will be closely monitoring the situation and providing updates on any new developments.

A link to the preliminary bill can be found here: The Tax-Relief for American Families and Workers Act of 2024 – Technical Summary